Open Interest hits 300KEris SOFR open interest hit 301,368 contracts on September 6, less than three months after crossing 200K in JuneFront-month open interest stands at 179,171, having more than tripled in 20245-year and 10-year front-month open interest are each more than 70,000 contracts, each having surpassed 50,000 since the June rollRead more

As the Federal Open Market Committee considers changes in its interest rate policy, managing swap spreads will be critical for dealer desks, asset managers and hedge funds. With many recent innovations and capital efficiencies, Eris/Treasury Swap Spread trading is helping clients more efficiently execute swap spread trades.

Trading swap spreads with Eris SOFR Swap futures and Treasury futures as CME Globex inter-commodity spreads unlocks the benefits of liquid, anonymous, electronic futures markets.

Contents

Overview & Top Benefits of Eris/Treasury Swap Spreads

Spread Basics: Contract Specifications

Eris SOFR Swap futures: Liquid futures for benchmark tenors of SOFR swaps

How to view markets for Eris/Treasury Swap Spreads

Comparison to Headline Spreads and Invoice Spreads

How implied prices maximize liquidity

Use Case 1: Spread trader takes a view on swap spreads simply, anonymously, & margin-efficiently

Use Case 2: Dealers hedge CME interest rate swaps electronically, with lower fees

Use Case 3: Portfolio Manager switches to swaps during the quarterly roll using a single spread trade, lowering execution cost

Read More at CME Group

During pandemic-driven market dislocations in March 2020, Real Estate Investment Trusts (REITs) were hit hard, with the S&P U.S. REIT Index falling 44% from its peak a month earlier. As the real estate market absorbed new realities of how people live and work, the REIT market was slower to bounce back than the broader market.Necessity drove multiple REITs to hoard cash by shedding interest rate swap hedges and replacing them with lower-margin Treasury futures. These events shined a spotlight on REIT hedge efficiency that persisted even after the market’s return to relative normalcy, spurring analysts to pay increased attention to margin minimization as a differentiator for maximizing Earnings for Distribution.Recent Happenings for Swap Futures Three recent events in the swap futures world caught our attention, prompting us to contemplate how much capital the top mortgage REITs could free up by replacing their interest rate swaps with Eris SOFR Swap futures (Eris SOFR).Click here to read more on CME Group Open Markets Eric Leininger Eric Leininger is Executive Director of Financial Research and Product Development at CME Group. He is based in New York.Michael Riddle is the CEO of Eris Innovations, the intellectual property licensing company that created Eris SOFR Swap futures, which are listed at CME Group. A 20-year veteran of the Chicago futures industry, he previously worked for the Chicago Board of Trade and CME Group. Since Eris SOFR’s recent volume and open interest growth started in 2023, he spends most of his time writing and talking about the product’s benefits for mortgage companies, REIT’s, regional banks and credit unions.

Eris SOFR: Record June caps record volume quarterEris SOFR average daily volume hit 17,122 contracts in June, a new monthly recordQ2 volume set a new quarterly record, the third consecutive quarter of growth since the June 2023 migration from Libor to SOFRThe 5-year and 10-year tenors are driving volume growth, spurred by new hedging activity from regional banks and mortgage companies CME Group: REITs are Switching to Swap Futures to Free Up CashCME Group recently featured Eris SOFR in an OpenMarkets blog entry on “the potential for a structural shift in the REIT industry in hedging efficiency"The article quotes Minnesota-based REIT Two Harbors regarding their recent public disclosure of using Eris SOFR for hedging: “We’re always looking for ways to manage capital more efficiently and hedging with swap futures combines the risk exposure of SOFR swaps with the margin efficiency of futures.”Based on public SEC filings and using the CME CORE margin calculator, the authors conclude “top REITs could save $1.5 billion in posted margin by switching to Eris SOFR swap futures”Open interest up 50% year to dateEris SOFR open interest is 259,849 contracts as of July 24, up more than 50% this year and up 25% since crossing 200K less than two months agoNearly all of the growth is in front-month open interest, which currently stands at 142,200 contracts, more than doubling since April 1Again, 5-year and 10-year tenors lead the way, with each now having surpassed 50,000 contracts in open interest

By Mike Vough – Vice President, Hedging and Trading Products, Optimal Blue

and Geoffrey Sharp – Managing Director, Head of Product Development and Sales at Eris Innovations

In both low and high origination environments, non-agency loans, such as jumbo, Non-QM, and Private-Label Security, are always flagged as potential growth areas for lenders. What has prevented these perennial projected growth areas from gaining steam?

Part of the issue holding back these types of loans from gaining more of a foothold comes down to the classic chicken or the egg causality dilemma. A liquid secondary market begets more production, and more production creates more liquidity in the secondary market. This situation is commonly seen in agency hedging when the market moves quickly, and new originations are slotting to coupons not yet liquid and commonly traded by broker-dealers. Originators must also deal with an opaque price discovery process due to the lack of a liquid secondary market. Could the lack of a trusted pricing strategy be leading to less origination, thus impacting the liquidity of the secondary market for these assets?

The lack of reliable pricing for bulk deals (or even in investor rate sheets) leads to originators using less sophisticated pricing strategies to price new originations that may not be fully grounded in reality. There is some convenience to pricing originations, bulk deals, and securitizations using the “finger in the air” approach of a simple spread over a selected US Treasury. However, this creates headaches for those trying to derive hedging strategies for short-term warehousing and longer-term investment strategies. If you cannot reliably and confidently price a loan, how can you hedge it with confidence? The flip side is that many vendors can supply complicated models with a great deal of flexibility, but the number of options and lack of tried-and-true strategies can leave lenders overwhelmed with too many options. Z-spreads, stochastic rate paths, Option Adjusted Spread (OAS), N-Spreads, and other modeling complexities add additional anxiety to this process.

If you made it this far, you may still be wondering what you can use to hedge these loans. Unfortunately, there isn’t a liquid jumbo forward contract available, like there is in agency originations. You could use Treasuries, but in addition to not having an embedded credit component, there is no way to build a tradable, forward term structure – a key component to financial modeling and loan pricing. It is unfortunate that U.K. regulators phased out LIBOR in June 2023, as it used to have a credit component with the capability to build a tradable, forward curve based on LIBOR swaps. Although to-be-announced (TBA) agency securities might seem appealing, despite their poor liquidity ever since the Federal Reserve stopped buying agency mortgage-backed securities (MBS), the risk characteristics of TBAs are not suited to pricing and hedging non-agency loans.

Click Here to Download the PDF...

Eris SOFR markets stay strong during $3B trading day Eris SOFR trading activity spiked notably on April 22, with 32,767 contracts ($3.3 billion notional) tradedActivity included more than $1.5B in outright 10y Eris SOFR (over $1.2mm DV01) and $1.5B in 5y Eris SOFR (nearly $700K DV01)Multiple participants called out the robustness of the Eris SOFR markets during this period, citing its capacity to take on large positions“On April 22, our team executed more than 30,000 Eris SOFR contracts for our clients,” said Rob Powell, Senior Managing Director of the Fixed Income Group at RJ O'Brien & Associates. “Eris SOFR markets remained solid throughout the day, and our clients were pleased with our ability to negotiate block-sized trades in line with transparent, electronically-posted prices.” Eris SOFR open interest surpasses 200,000Eris SOFR open interest recently surpassed 200,000 contracts ($20B notional), setting a new recordLaunched in 2020, Eris SOFR surged in trading activity and open interest in 2023 as SOFR replaced LIBOR as the pre-eminent U.S. interest rate benchmarkIn 2024, front month open interest is up 59% and overall open interest is up 19%Growth is focused in the 5-year and 10-year tenors, driven by new hedger clientsClick Here to Read More

Hedge accounting for the masses:How futures and FASB changed hedging foreverView ArticleWho should read it?Banks and credit union executives looking to use swaps and apply hedge accounting to manage interest rate risk What is it about?The authors show how advancements in trading swaps (Eris SOFR Swap futures) and applying hedge accounting (recent FASB guidance, especially the “Portfolio Layer Method”) combine to make hedging more accessible by decreasing the cost and complexity Don’t miss the hedge accounting case studiesJump to the last section to see case studies demonstrating ledger-level accounting detail for designating Eris SOFR Swap futures as cash flow and fair value hedges About the AuthorsEric Leininger is Executive Director of Research and New Product Development for Interest Rates and Equities for CME Group. The Research and Product Development team develops new risk management products as well as ensuring the continued relevance of CME Group's current suite of key benchmarks. The team also produces original research into derivatives and their underlying markets across asset classes and around the world.Craig Haymaker is a managing director with Eris Innovations, responsible for hedging solutions. Prior to Eris, he was a managing director with HedgeStar—an outsourced, back-office hedging provider—overseeing sales, marketing, and operations. Craig is a Certified Public Accountant whose career has been focused on risk management and financial products at Deephaven Capital Management, Deloitte & Touche, Liberty Mutual Group, and US Bancorp. Craig is also a board member with the Professional Risk Managers International Association (PRMIA).

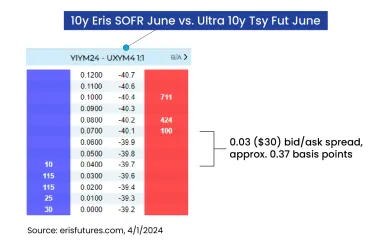

Bid/ask spreads of Eris/Treasury futures Inter-Commodity Spreads (ICS) continued to tighten in March, with 10-year Eris SOFR vs. CME Ultra 10-year Treasury Futures 0.5 bp or tighter 42% of regular trading hoursThese ICS allow for trading swap spreads in futures form, with electronic execution in lots sizes of $100K notionalTo view market data, request the Eris ICS Bloomberg Launchpad, or visit erisfutures.com/live Click Here to Read More

3-minute video from CME Group gives overview of using Eris SOFR for hedging exposure to interest rates

Video shows a commercial loan example of a real estate developer borrowing money at a floating interest rate to fund a 5-year project, then using Eris SOFR to hedge against interest rate increases jeopardizing project profitability

It’s an excellent introduction for other hedgers, as well, (e.g., bank balance sheet, mortgage pipeline, mortgage servicing rights), as it covers the basics of Eris SOFR product design and futures market operation